Open communication with employees about these adjustments is crucial, as clarity helps manage expectations and prevent misunderstandings. Expenses, on the other hand, must be recorded in the accounting period in which they are incurred. Therefore, accrued expense must be recognized in the accounting period in which it occurs rather than in the following period in which it will be paid. Cash accounting, on the other hand, records income and expenses when you receive or deliver payment for goods and services. Accrual accounting is an accounting method that records revenue and expenses when you provide or receive a product or service instead of when you make or receive a payment. Even more complicated are transactions that require paying for goods or services or receiving money from customers in advance.

Accrual Accounting Definition

If the business is run by a sole proprietor and only deals in cash, then cash basis accounting might be the right accounting method. But, in most cases, accrual accounting makes better financial sense, especially as the company grows and begins to require accountability to stakeholders. The accrual method looks at transactions but does not account for actual cash flows within the business. For example, your income statement might show sales revenue, but the client may take months to pay their invoice. If you have prepaid expenses, it means you’ve already made cash payments for goods and services that you haven’t yet received.

Choosing the Right Accounting Method

Since accrued expenses and revenue must be accounted for before the actual cash transaction occurs, they affect net income. Accrual accounting differs from cash accounting because it includes revenue that has yet to be collected (accounts receivable) and expenses that have yet to be paid out (accounts payable). The accounting journal is the first entry in the accounting process where transactions are recorded as they occur. If the company receives an electric bill for $1,700, under the cash method, the amount is not recorded until the company actually pays the bill.

What Is the Difference Between Cash Accounting and Accrual Accounting?

- This is important because financial statements are used by a wide range of stakeholders to evaluate the financial health and performance of a company including investors, creditors, and regulators.

- The United States uses a separate set of accounting principles, known as generally accepted accounting principles (GAAP).

- The timing of when revenues and expenses are recognized related to these more complicated transactions can have a major effect on the perceived financial performance of a company.

- This principle, known as the matching principle, provides a clearer picture of a company’s profitability by linking expenses directly to the revenue they produce.

As organizations strive to balance operational needs with employee well-being, understanding the nuances of vacation accrual becomes increasingly important. There is no definition of double entry in the Conceptual Framework – although it is probably fair to say that this is the most fundamental underpinning principle in accounting. In the absence of a formal definition, it is best to start by understanding the term ‘dual aspect’. The dual aspect means that each party in a transaction is affected in two ways by the transaction and that every transaction gives rise to both a debit entry (Dr) and a credit entry (Cr). Overall, appropriate application of the accrual concept is important in business as it helps you get an accurate picture of the business finances.

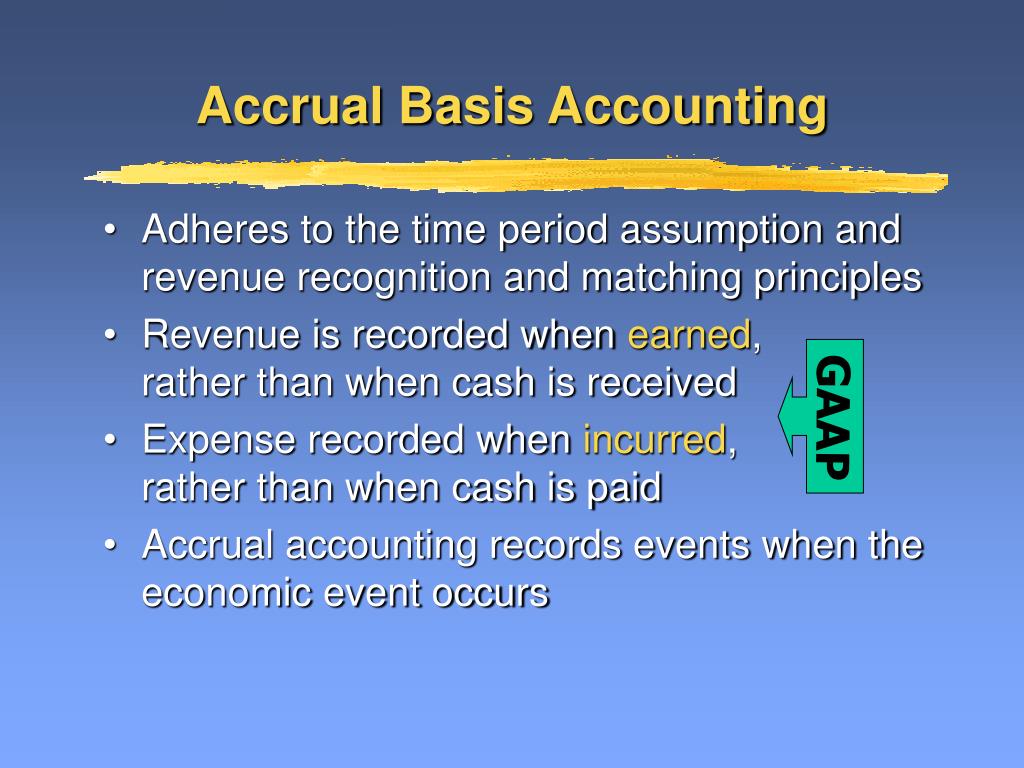

The accrual concept focuses on transactions when incurred, while the matching concept aligns expenses with revenue. Accrual accounting is an accounting method where revenue or expenses are recorded at the time in which they are earned or incurred, irrespective of when the actual cash transactions occur. It utilizes two core accounting principles, the matching principle and the revenue recognition principle. Revenue recognition is a fundamental aspect of accrual accounting, shaping how businesses report their financial performance. The principle dictates that revenue should be recognized when it is earned and realizable, not necessarily when cash is received. This approach ensures that financial statements reflect the true economic activities of a business, providing a more accurate picture of its financial health.

But it will not be updated to reflect the current value of a similar asset or liability which might be acquired or taken on. Arguably, the biggest risk in this regard is that a business will be inclined to be optimistic about results and therefore overstate assets and income or understate liabilities and expenses. There could be financial incentives for business owners to do this and therefore the prudence principle must be observed to ensure this does not happen. Since the differences between sales or revenues and expenses represent profit, owners’ equity will show an increase if profits are earned (or a decrease if losses are incurred). According to the accounting equivalence concept, when sales of goods or services are made, assets are likely to go up, either by way of cash or accounts receivables. Accrual accounting is when you recognize a transaction in your journal entry when it happens instead of when you receive payment.

The form of financial accounting that allows companies to keep up with these more complicated transactions is called accrual accounting. As a result, more companies are looking for highly skilled financial accounting professionals, well-versed in this method. Here’s an overview of the accrual accounting method and why so many organizations rely on it. Yes, if an organization needs to be compliant with GAAP, it needs to utilize an accrual accounting method. Accrual accounting ensures that all the financial statements and reports generated are GAAP-compliant.

This means that a company may have accrued expenses and revenue but not recorded them yet in their financial statements if they expect to receive payment or make payments at some point in the future. The offset to an accrued expense is an accrued liability account in double-entry bookkeeping. The offset to accrued revenue is an accrued asset account and this also appears on the balance sheet. An adjusting journal entry for an accrual will therefore impact both the balance sheet and the income statement. Accruals and deferrals are the basis of the accrual method of accounting, the preferred method by generally accepted accounting principles (GAAP).

However, under the accrual method, the $1,700 is recorded as an expense the day the company receives the bill. The accrual method is the more commonly used method, particularly by publicly traded companies. One reason for the accrual method’s popularity is that it smooths out earnings over time since it accounts for all revenues and expenses as they’re generated.

Generally accepted accounting principles (GAAP) are uniform accounting principles for private companies and nonprofits in the U.S. These principles are largely set by the Financial Accounting Standards Board (FASB), an independent nonprofit organization whose members are chosen by the Financial Accounting Foundation. Accounting principles are the tax forms and what you need them for rules and guidelines that companies and other bodies must follow when reporting financial data. These rules make it easier to examine financial data by standardizing the terms and methods that accountants must use. As each month of the year passes, the gym can reduce the deferred revenue account by $100 to show it’s provided one month of service.

This does not mean that everything in the accounts needs to be treated the same by every entity. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. In fact, it is not at all unusual to find that a business with large profits, but which has also identified many areas for profitable investments, is short of cash. Similarly, there is no reason to believe that because a business enterprise is short of cash, it is unprofitable.

No comment yet, add your voice below!